“My Uncle Owns It” — The IRS Don’t Care, Bro

- Dr. Money Savvy

- May 27, 2025

- 2 min read

Let’s talk about a popular game some U.S. taxpayers like to play:

🕵️♂️ Hide and Seek: Foreign Asset Edition

“The house? Oh that’s under my uncle’s name.”

“My mom holds the account, but it’s really mine.”

“The business? My cousin runs it, I just, like, funded it.”

🛑 STOP.

The IRS doesn’t care whose name is on it. If you control it, benefit from it, or wired Auntie money to “hold it for you,” congratulations — it’s yours.

And guess what? There’s a line of people waiting to snitch for cash.

💵 The IRS Will Literally Pay Your Cousin to Rat You Out

Let’s say you’ve been quietly collecting rent from your apartment in Vietnam. The title is under your brother's name. The income goes into a “family account.” You never report it because, duh, “it’s not in your name.”

Well, the IRS has a whistleblower program.

And your brother, your ex, your vengeful second cousin — they can fill out a simple Form 211, send it to the IRS, and if the IRS recovers money from you?They get up to 30%.

So if they find out you owe $100,000 in back taxes, guess what? Your cousin just got $30,000 richer... for selling you out.That’s not a betrayal. That’s a business decision.

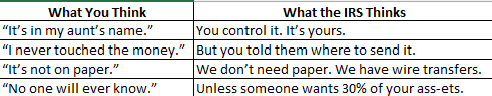

📉 Real Talk: What You Think vs. What the IRS Thinks

🧨 A Real (But Slightly Made-Up) Story

Chad (yes, him again) bought into a commercial building in Vietnam in 2005. Ten percent stake. He had his cousin hold the title. Every year, rent money flowed into a Vietnamese bank account. Chad skimmed off the top and moved on. No FBAR. No FATCA. No tax reporting. Just vibes. Until 2025 — when Chad’s cousin got mad that Chad wouldn’t split a motorbike purchase.

One Form 211 later, the IRS showed up.

Twenty years of non-compliance = six-figure problem.

Cousin? $22,000 richer. Chad? Not so much.

🛠️ What To Do If You’ve Been "Off the Grid"

First off, relax. You’re not the only one. We see this all the time.

Second, fix it before your cousin files that form. Here's how:

1. File your FBARs (foreign accounts over $10K? Yeah, that’s you).

2. Report your foreign rental income. Even if your mom collected the cash.

3. File Form 8938 if your foreign assets are worth reporting (hint: they probably are).

4. Use the IRS Streamlined Procedures to get compliant without getting wrecked.

5. Talk to us before you do something dumb like sell the property and send $200K to your Chase account.

💬 Final Word

There’s a time and place to trust your family.

Foreign real estate isn’t it.

The IRS doesn't care about your WhatsApp agreement or your "it’s just for the kids" story. If you touch it, control it, or benefit from it, it’s yours in the eyes of Uncle Sam.

So before your uncle, cousin, ex, or neighbor with IRS beef files Form 211, let us help you clean this up. Quietly. Legally. Humorously.

Comments